- The WooCommerce Ideas Board has moved to WooCommerce.com’s Feature Requests Portal. Please see our Feature Requests documentation for more info.

WooCommerce is the platform that grows with you

No matter what success looks like for you, you can do it with WooCommerce. Our WordPress-based ecommerce platform helps merchants and developers build successful businesses for the long term.

How can Woo help you?

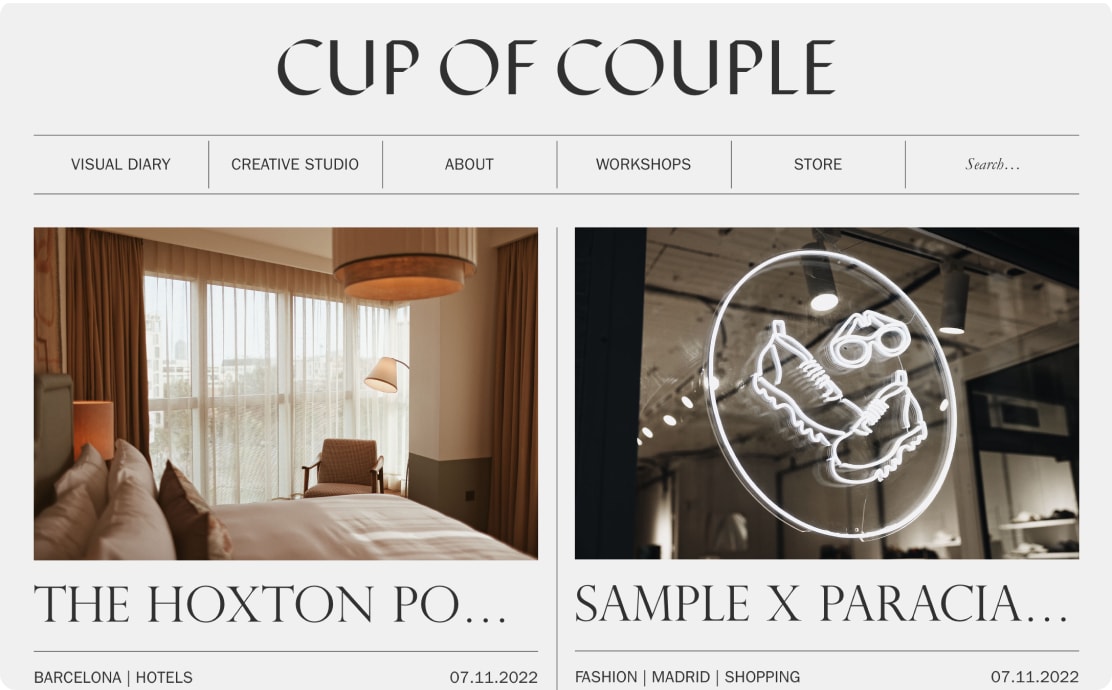

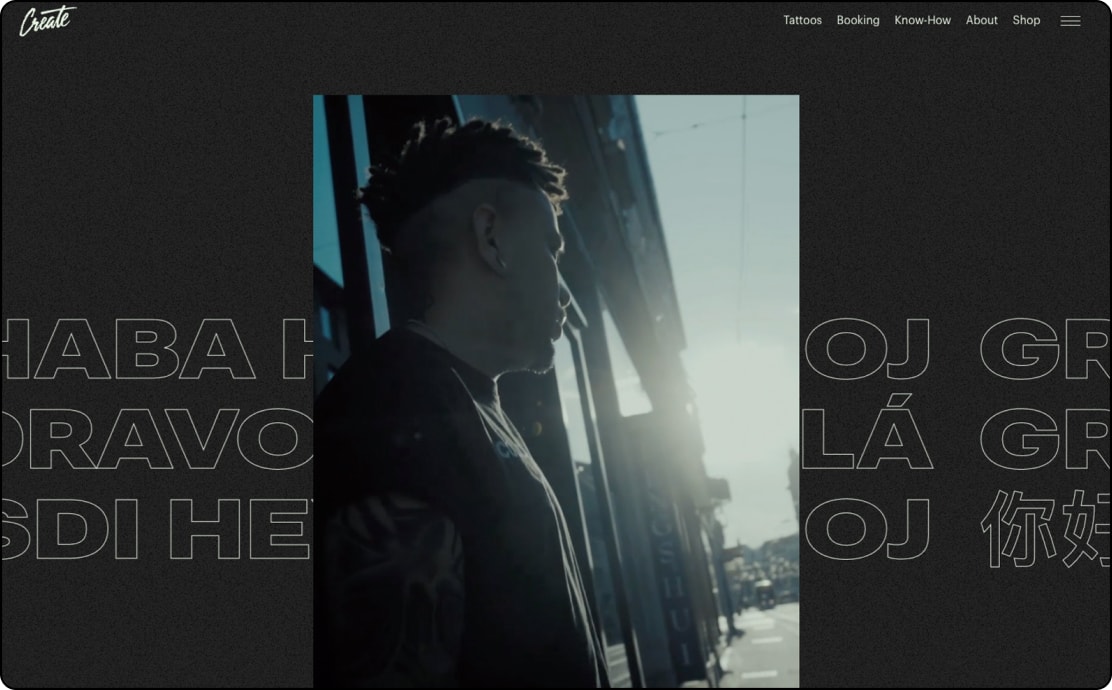

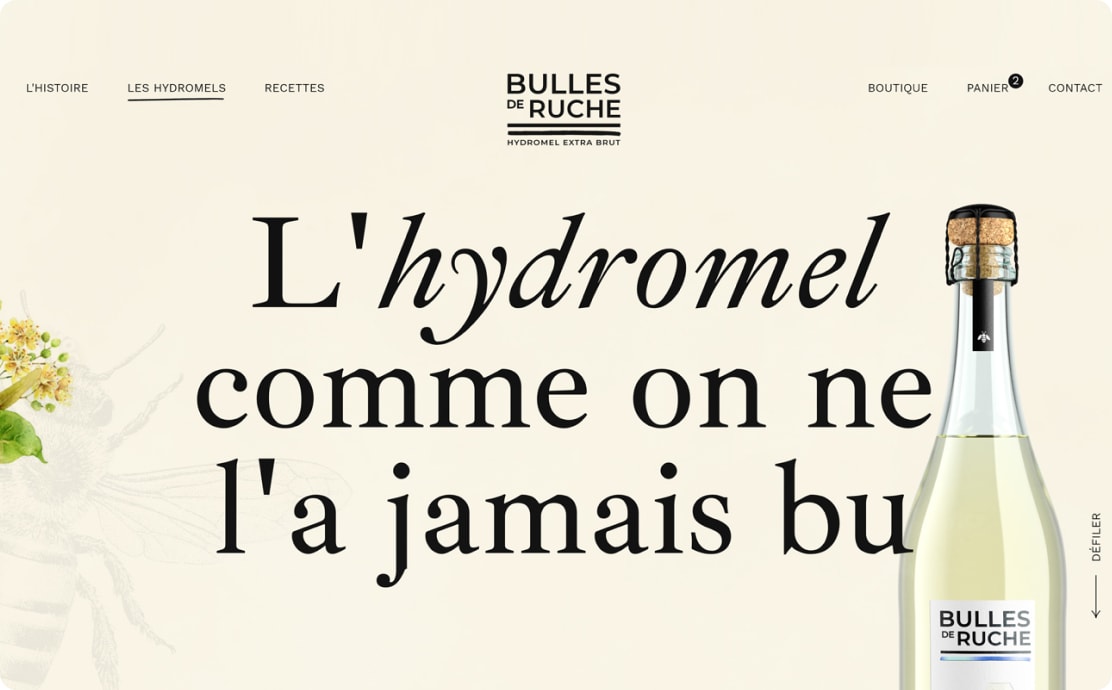

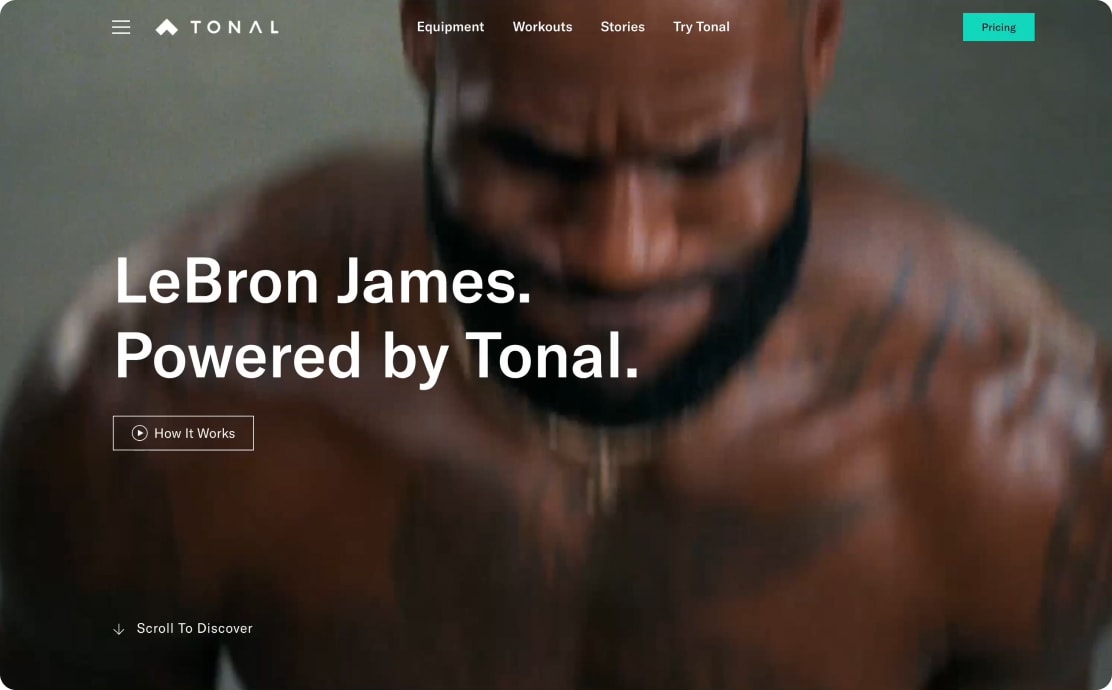

Loved by millions of brands 💜

Get expert help

with WooCommerce

Save time, sell more, and stay ahead of the competition — hire one of our trusted WooExpert agencies to help you start or optimize your WooCommerce store.

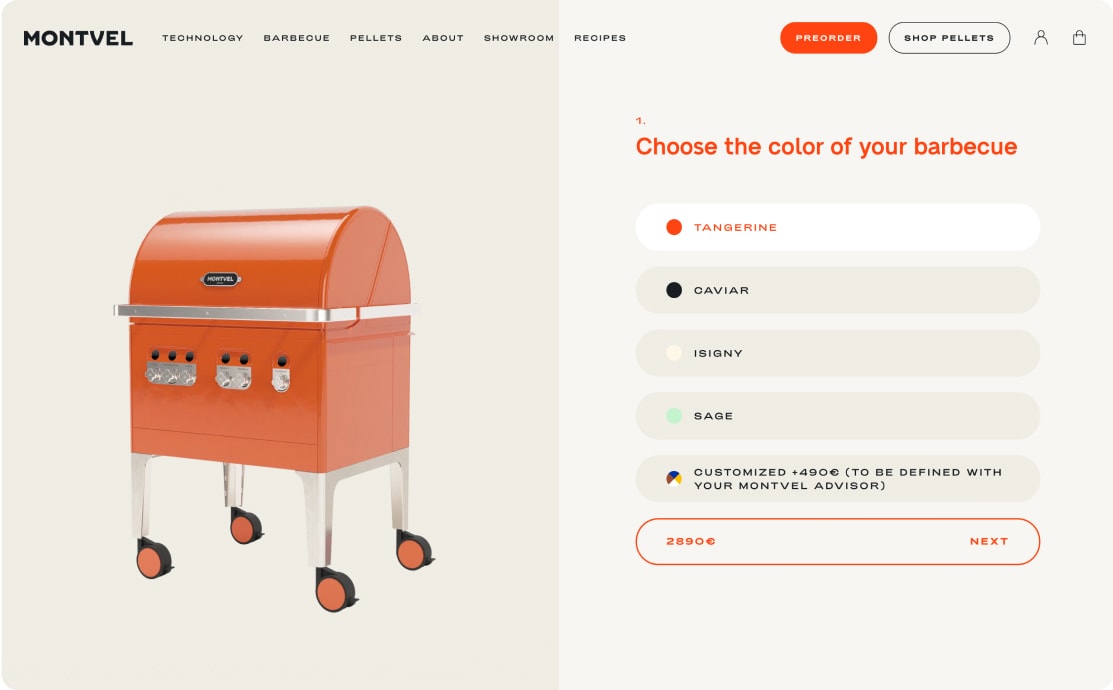

Power up your

WooCommerce store

Already sell on Woo? Our Marketplace has hundreds of extensions and themes to boost your conversion and streamline your business.

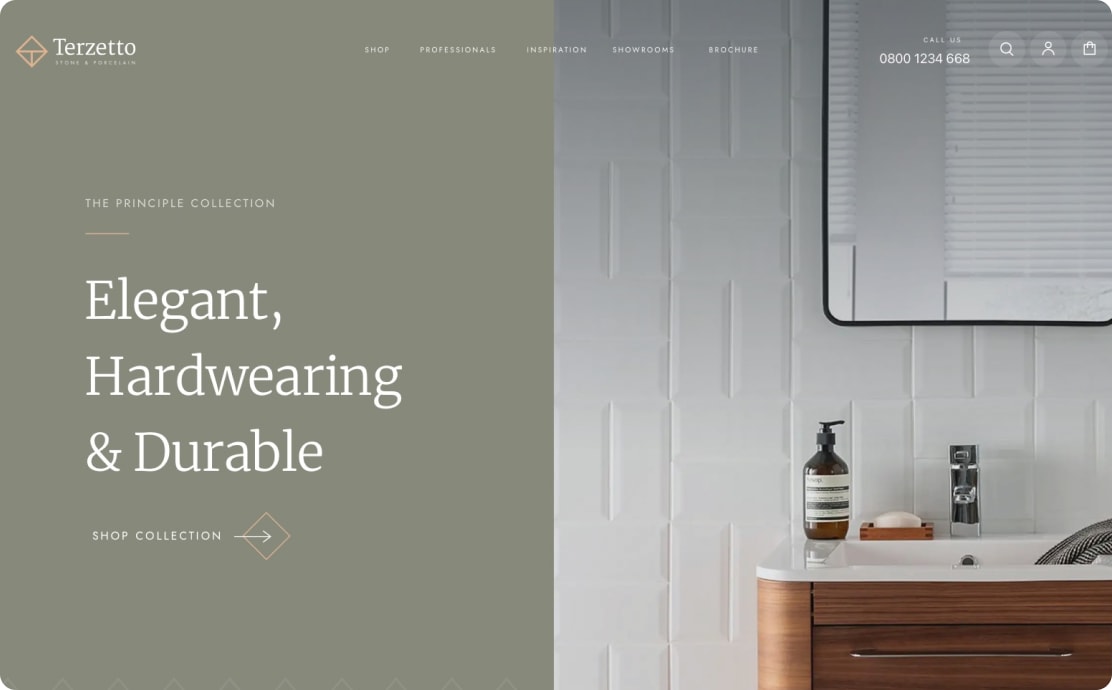

Custom solutions

for high-volume stores

Woo offers next-level customization, advanced selling features, and dedicated support to help established merchants continue growing.

The most-trusted ecommerce platform for building success ✨

43%

of the web is built

on WordPress

W3Techs, Usage Statistics and Market Share of WordPress

Start growing your business with Woo

Whether you’ve got dreams of selling online or want to build stores for others, you can do it with Woo. Start your journey by finding a host.

Chris Lema,

Chris Lema,  Kathy Darling,

Kathy Darling,